Unite the Union Members' Pay Claim for THE CO-OPERATIVE BANK P.L.C.

Unite the Union Members' Pay Claim for

THE CO-OPERATIVE BANK P.L.C.

2022 - 2023

Claim produced 20 October 2022 12:31:56

CURRENT PAY CONTEXT

Finance & Legal Sector

Median Earnings in ASHE

Earnings for full-time employees in the UK are recorded by the Annual Survey of Hours and Earnings (ASHE). The most common method of recording pay in ASHE is the median rate (the mid-point where half employees are above and half are below).

The evidence from ASHE proves that the weekly wage for full time workers in THE CO-OPERATIVE BANK HOLDINGS LIMITED needs to increase.

The Cost of Living

Year-on-year rises in the cost of living are a direct hit to the livelihoods of Unite members. While THE CO-OPERATIVE BANK P.L.C. can plan to offset the inflation of its operating costs, this option is not open to our members outside of this claim. The evidence below proves that the employer must significantly increase rates of pay in this year's pay round.

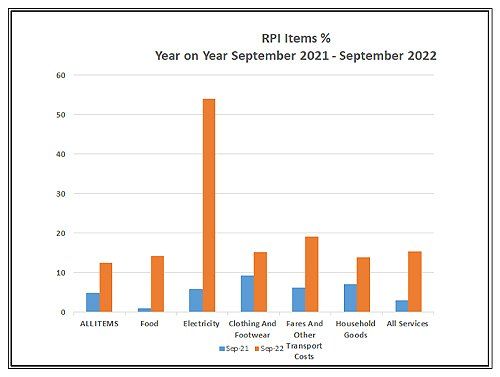

The UK's Retail Prices Index (RPI) increased to 12.6% in the 12 months to September 2022.

Retail Prices Index (RPI) Changes for the 12 months to September 2022¹

| RPI BASIC ITEMS² | LAST YEAR | THIS YEAR |

|---|---|---|

| ALL ITEMS | 4.9% | 12.6% |

| Food | 0.9% | 14.3% |

| Electricity | 5.8% | 54% |

| Clothing & footwear | 9.3% | 15.2% |

| Fares & other transport costs | 6.2% | 19.2% |

| Household goods | 7% | 13.8% |

| All services | 3% | 15.4% |

Source: Office for National Statistics, October 2022

Food Costs

The Office of National Statistics (ONS) has recorded that the cost of food has increased 14.3% over the last year.

This is higher than the UK's overall RPI figure.

As with other basic amenities, food price inflation creates unavoidable costs. Such items also take up a greater proportion of our members' earnings than they do for those on higher pay.

Transport Costs

The cost of transport has increased 19.2% over the last year.

This is higher than the UK's overall RPI figure.

Transport is a basic amenity and transport inflation creates unavoidable costs, including an increase in the cost of getting to and from work. As with other core expenses, such essential travel takes up a greater proportion of our members' earnings than it does for higher paid staff within the organisation.

Electricity

ONS data shows that the cost of paying for electricity has increased by 54% over the last year.

This is higher than the UK's overall RPI figure.

These bills are a significant expense for our members, who have no choice but to meet the additional costs from elsewhere in their budgets.

Housing Costs

In September 2022 the Bank of England increased interest rates by 0.5%. This is likely to have an ongoing knock on effect with major banks and building societies increasing their lending rates.³

Mortgage Rates

Average mortgage rates now stand at 5.4% up from 4.41% in October 2021 - an increase of 0.99%, adding a further unavoidable burden upon many of our members.⁴

¹https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/consumerpriceinflation

Table 41

²https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/dogd/mm23

³https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate

⁴Moneyfacts October 2022 p1

ABILITY TO PAY

The parent company of THE CO-OPERATIVE BANK P.L.C. (THE CO-OPERATIVE BANK HOLDINGS LIMITED) has had a very impressive financial performance. Our members must now be rewarded for the success they have contributed to. The following examples from the 12/2021 accounts prove that THE CO-OPERATIVE BANK HOLDINGS LIMITED is well positioned to meet our demands:

Key Figures from THE CO-OPERATIVE BANK HOLDINGS LIMITED Accounts 12/2021

| ACCOUNTS ITEM | 2020 | 2021 | % CHANGE |

|---|---|---|---|

| TURNOVER | £491.5m | £521.5m | 6.1% |

| TURNOVER PER EMPLOYEE | £170,069 | £198,289 | 16.6% |

| PRE-TAX PROFIT | -£103.7m | £31.1m | back in profit |

| PROFIT PER EMPLOYEE | -£35,882 | £11,825 | back in profit |

■ An increase in turnover of 6.1% to £521.5m

■ An increased turnover per employee to £198,289

■ An increase in Pre-Tax profits to £31.1m

■ A rise in profit generated per employee of back in profit

| ACCOUNTS ITEM | % CHANGE |

|---|---|

| PROFIT MARGIN FROM THE CO-OPERATIVE BANK HOLDINGS LIMITED ACCOUNTS 12/2021 | 5.96% |

■ A pre-tax profit of 5.96% of turnover

Our members therefore expect to share in this success, knowing full well that THE CO-OPERATIVE BANK HOLDINGS LIMITED can comfortably meet this claim in full.

DETAIL OF CLAIM

INTRODUCTION

Unite is pleased and relieved that the Bank has finally turned the profit corner, and the additional pay rises have been very welcome. However, we continue to maintain the very difficult circumstances which we have endured for over 10 years have had a profound and long lasting impact on the pay and working life of Bank employees. Our members have understood the need for change to make the business sustainable in the long term, but there is still significant ground to make up in terms of remuneration. Coupled with the current cost of living crisis, increasing levels of inflation and difficulties recruiting and retaining staff, we make no apology for the earnest requests we are asking the business to consider for 2023 –

PAY

- Inflation is rising rapidly. The cost of living is under sustained pressure. Unfortunately last years’ pay increase was quickly overshadowed by the rate of inflation. Unquestionably all staff need a real, substantial and above RPI pay increase. Particular attention needs to be given to those at the lower end of the pay scales.

- In line with Unite policy we request that any pay increase be delivered across the board for all groups of staff, at the same percentage rate.

- Reintroduction of a process to move staff towards pay reference in a reasonable time frame. For many, pay reference has been an unattainable goal for a long time, which is clearly unjust and undermines the concept of the ‘rate for the job’.

- Reintroduction of pay band minima and maxima, the lack of which continues to undermine staff confidence in the reward system.

- Pay disparities between existing and new staff create a perpetual unfairness and a continuous feeling of being undervalued. Many long serving staff have complained to us about having to train new starters who are already earning more money than them to do the same job. Not only does it feel unfair, those pay disparities are the perpetuated into the future as there is no mechanism for equalising pay other than performance. In effect, longer term staff never catch up. Once again, we continue to seek urgent discussions with a view to resolving this issue.

- Our members who are significantly above their pay reference, have been frustrated at not receiving a full rise for their given performance rating. We request a lump sum payment equating to the remainder of the rise they would have received if they had not been constrained by their pay position.

- We believe that bonus payments must to be more generous than in recent years, and need to be used by the business to signal increased confidence in the future. Notwithstanding all of the above, we would welcome further discussions regarding future variable pay / bonus arrangements.

- In the current serious economic circumstances, it is imperative that no member of staff should receive a ‘zero’ pay increase.

TERMS AND CONDITIONS

- Positive changes to sick pay entitlement / reducing the amount of time it takes to reach maximum entitlement. Current provision for staff with less than 5 years’ service is inadequate and does not give enough support in the case of serious illness. In addition, the provision of Income Protection is only available to staff who have been absent from work for 52 weeks, which means there is a gap in provision for staff with less than 5 years’ service.

- 360 performance feedback to become mandatory - from an ethical standpoint, staff should be able to rate how well their managers are doing on an annual basis. At the present time performance feedback is only done on a top down basis, which affords no opportunity for constructive bottom up feedback. We appreciate that the introduction of such a facility may cause concern, but if appropriately constructed and implemented would further increase management capability and enhance performance and confidence across the business.

- Increased pay transparency for Band B’s. The lack of transparency is undermining confidence.

- Reintroduction of staff loans and mortgages for the benefit of staff, and the Bank through increased business. Given the current economic conditions, this could be another avenue to providing financial support for staff. We consider that such a provision would be highly valued by those that may use it, and would be a benefit in recruiting and retaining staff as very few organisations offer this now.

- Homeworking allowance to be introduced. The additional expenses incurred whilst working from home are rising exponentially during the cost of living crisis, and are set to get worse. We feel that the Bank needs to recognise the increasing impact of the cost of homeworking, as well as the recent withdrawal of the tax allowance.

- Single Parent / Carer Banked time provision (see Appendix 1) – we believe such an ethical provision would be highly valued by those that may need it, and would be another benefit in recruiting and retaining staff.

- Provision of free sanitary products in Bank premises (for more detail, see - https://www.heygirls.co.uk/private-sector/).

- Reintroduction of paid Public Duty Leave, in line with the community values of the Bank and the desire of staff to give back to society.

- The level of reorganisation across the Bank in the last few years has led to substantial changes in roles and workloads. We have included 2 questions related to this issue in our annual pay survey (specifically 1. Does your role description reflect what you do, & 2. Does your pay reflect the work that you do). We believe a re-evaluation of all roles is long overdue, and now is an appropriate time to start that work to ensure role descriptions and grades accurately reflect the work being done.

- Increase in pension contributions to give staff added security about their retirement.

- Development of Mental Health and Wellbeing Policies.

© 2022 - Unite the Union